Cibil Score plays a critical role in the loan approval process. Your credit score gives loan providers an indication of your capability to pay back a loan. Every lender that uses the Cibil score has its own benchmark of what constitutes a “good score”.

India's first credit information bureau- is a repository of information, which contains the credit history of commercial and consumer borrowers. CIBIL provides this information to its Members in the form of credit information reports.

CIBIL is the repository of information which has been pooled in by all Banks and lending Institutions operating in India. Presently, CIBIL have a database size of over 170 million consumer records and 6.5 million company records contributed by our over 500 Members.

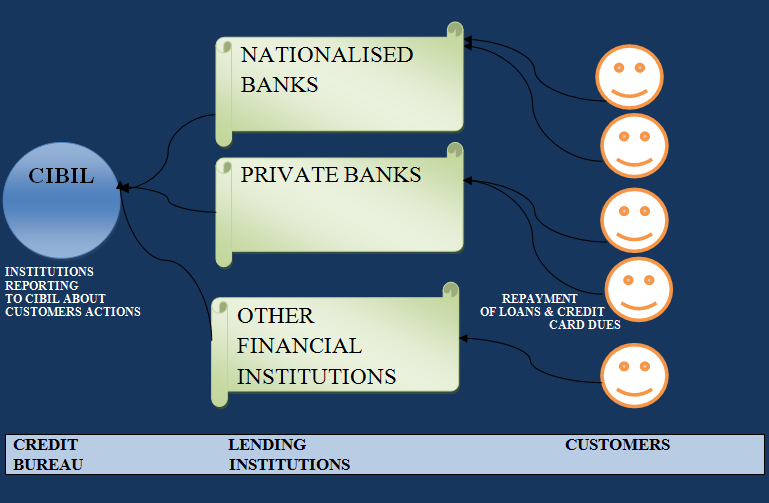

CIBIL’s aim is to fulfill the need of credit granting institutions for comprehensive credit information by collecting, collating and disseminating credit information pertaining to both commercial and consumer borrowers, to a closed user group of Members. Banks, Financial Institutions, Non Banking Financial Companies, Housing Finance Companies and Credit Card Companies are the members of CIBIL who use its services.

The establishment of CIBIL is an effort made by the Government of India and the Reserve Bank of India to improve the functionality and stability of the Indian financial system by containing Non Performing Assets (NPAs) while improving credit grantors’ portfolio quality. CIBIL provides a vital service, which allows its Members to make informed, objective and faster credit decisions.

A CREDIT SCORE is a measure of how carefully you make payments relevant to loans, credit cards and so on.

Considering the important role your credit report plays in your financial life especially with relevance to loan borrowing and establishing credit worth, it’s time you put some thought into how best you can make your credit report work to your advantage.

The CIBIL Credit Score System is in the range from 100 to 900. This score is based on the behavior of repayments of Installments of Loans and Credit card dues.

If your credit score is less than 600, then the chances of getting credit is very less and even if you will get credit then Credit Term will be very tough like requirement of higher Own Contribution, additional collateral & guarantor and higher interest rates. If you CIBIL Score is more than 800 Lender will be flexible in providing credit. You can get funds at lower interest rates; they can also reduce processing fees

CIBIL is a composite Credit Bureau, which caters to both company and consumer segments. The Consumer Credit Bureau covers credit availed by individuals while the Company Credit Bureau covers credit availed by non-individuals such as partnership firms, proprietary concerns, private and public limited companies, etc.

CIBIL primarily gets information from its Members (Banks & Financial Institutions) only and at a subsequent stage will supplement it with public domain information in order to create a truly comprehensive snapshot of an entity’s financial track record.

For credit grantors to gain a complete picture of the payment history of a credit applicant, they must be able to gain access to the applicant's complete credit record that may be spread over different institutions. CIBIL collects company and consumer credit-related data and collates such data to create and distribute credit reports to Members.

CIBIL primarily gets information from its Members (Banks & Financial Institutions) only and at a subsequent

stage will supplement it with public domain information in order to create a truly comprehensive snapshot of an entity’s financial track record.

A Credit Information Report (CIR) is a factual record of a borrower's credit payment history compiled from information received from different credit grantors. Its purpose is to help credit grantors make informed lending decisions - quickly and objectively.

CIBIL Consumer Credit Information Report (CIR) provides information on credit histories of borrowers to make objective lending decisions. With CIBIL Consumer CIRs credit grantors are equipped to gain insights into a consumer’s overall borrowings across lending institutions, identify risk areas, disburse credit faster and with greater efficiency and grow business profitability. The credit information is based on the millions of updates received by CIBIL from its strong member base comprising of Banks, Financial Institutions, State Financial Corporations, Non-Banking Financial Companies, Housing Finance Companies and Credit Card Companies.

CIBIL Consumer Credit Information Report (CIR) provides information on credit histories of borrowers to make objective lending decisions. With CIBIL Consumer CIRs credit grantors are equipped to gain insights into a consumer’s overall borrowings across lending institutions, identify risk areas, disburse credit faster and with greater efficiency and grow business profitability. The credit information is based on the millions of updates received by CIBIL from its strong member base comprising of Banks, Financial Institutions, State Financial Corporations, Non-Banking Financial Companies, Housing Finance Companies and Credit Card Companies.

India’s first credit scoring model that helps effectively predict the likelihood of an applicant becoming more than 91 days delinquent on one or more tradelines over the subsequent 12 months. This considers all trades (secured & unsecured) of a borrower for scoring.

India’s first and only offering to provide analytics on the likelihood of applicants or customers becoming 91 days delinquent on a personal or consumer loan over the next 12 months. Only Personal Loan (unsecured) trades are considered for scoring.